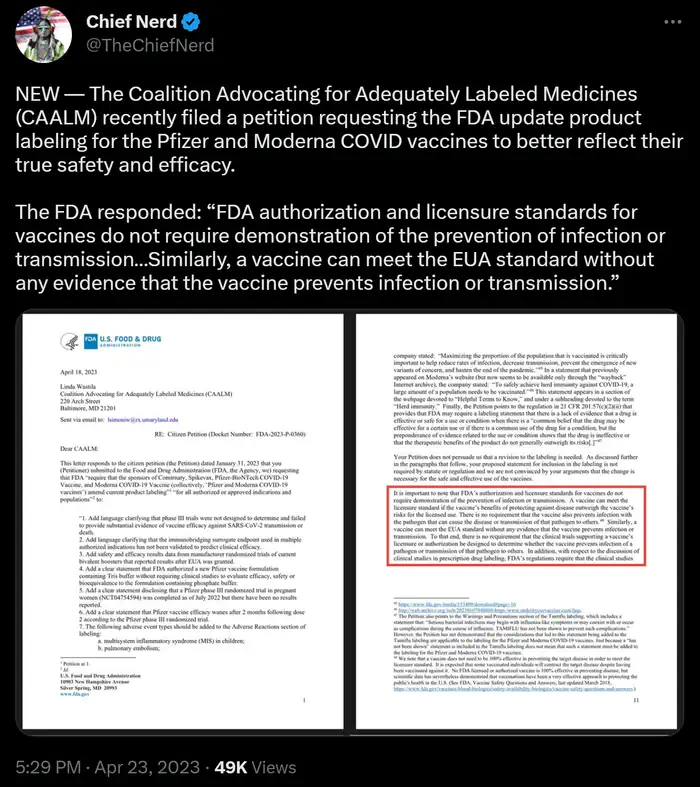

Also see:

Vaccine Attorneys

Legal Obstacles

- Most vaccine cases always come back to Jacobson v. Massachusetts (1905).

- The federal government is given the authority to mandate vaccination for the greater good of the country.

- But, with exceptions (medical, religious).

- Even recent legal victories such as Tandon v. Newsom (2021) are derived from Jacobson v. Massachusetts (1905).

- Notable legal concepts include:

- “under close scrutiny”

- “no less restrictive option”

- Notable legal concepts include:

- Even though you are supposed to have rights by default, courts have strayed far from this notion.

- Courts now rely on case law or SCOTUS judgments.

- In the new legal paradigm that you need a law to have it be a paradigm (and also the leftist idea that freedoms come from the government), the Constitution and Bill of Rights do not grant the right of medical freedom.

- Therefore, judges and the general public believe that the US Government have the authority to protect the population through mass vaccinations.

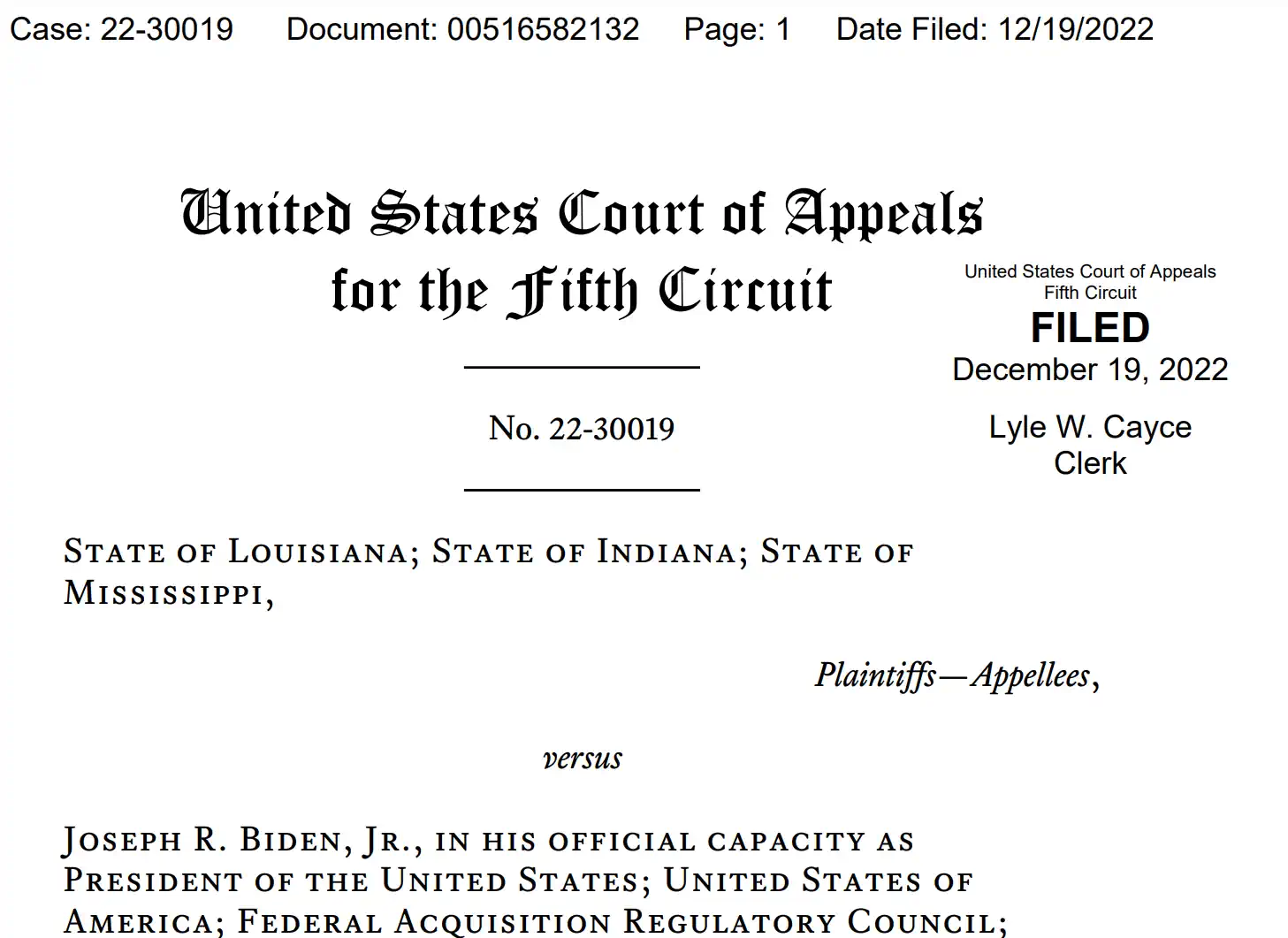

Court Cases

- Jacobson v. Massachusetts (1905).

- Ok to mandate smallpox vaccinations

- The federal government is given the authority to mandate vaccination for the greater good of the country.

- But, with exceptions (medical, religious).

- Buck vs Bell (1927)

- “Three generations of imbeciles are enough.”

- Eugenics case

- Constitutionally permissible for state to mandate forced sterilization for certain classes of people

- Has not been overturned

- Tandon v. Newsom (2021) are derived from Jacobson v. Massachusetts (1905).

- Notable legal concepts include:

- “under close scrutiny”

- “no less restrictive option”

- Notable legal concepts include:

- Trans World Airlines, Inc. v. Hardison, 432 U.S. 63 (1977)

Possible Legal Remedy

- There is a legal theory that a religious exemption to getting vaccinated will hold up in court.

- In order for a law to be valid, it must apply to everyone equally or undergo scrutiny.

- Not everyone can get the vaccine law applied equally because in some people, the vaccine would cause harm to them, as in the case of people who have had Guillaine Barre Syndrome.

- So under scrutiny, if they make medical exemptions for vaccinations, then certainly other exemptions must also be made, particularly a religious exemption which is codified in the 1st Amendment of the Bill of Rights.

- The government’s goal to requiring vaccination would be to reach herd immunity. It is believed that only 70% of the population must be vaccinated in order to reach herd immunity.

- The government has to enforce laws in such a way that it is the least restrictive way possible. If it can reach herd immunity with only 70% vaccination, then 30% can be left unvaccinated. It would be unnecessarily restrictive to require 100% vaccination.

- Source: 2-24-2021, My Body, My Temple: The Constitutional Requirement for Religious Exemptions to a COVID-19 Vaccination Mandate, Ben Davisson, Saint Louis University School of Law.

- PDF: https://mymedicalfreedom.org/wp-content/uploads/2021/08/My-Body-My-Temple_-The-Constitutional-Requirement-for-Religious-highlighted.pdf

- My Body My Temple_ The Constitutional Requirement for Religious (highlighted)

EEOC

https://www.eeoc.gov/foia/eeoc-informal-discussion-letter-250

EEOC Informal Discussion Letter

EEOC Office of Legal Counsel staff members wrote the following informal discussion letter in response to an inquiry from a member of the public. This letter is intended to provide an informal discussion of the noted issue and does not constitute an official opinion of the Commission.

Title VII: Religious Accommodation

March 5, 2012

ADDRESS

Dear ____:

Your letter dated February 7, 2011, addressed to the Chair of the U.S. Equal Employment Opportunity Commission (EEOC), has been directed to me for reply. You have inquired about the application of Title VII of the Civil Rights Act of 1964, as amended, to health care workers’ requests for exemption from employer-mandated vaccinations, as well as several related issues. Although your correspondence requested that the Commission exercise its discretion to issue a formal interpretation or opinion pursuant to 29 C.F.R. § 1601.91, I am responding by informal discussion letter in light of the information available in existing Commission publications addressing the relevant legal standards.

Infection Control Practices, Vaccination Requirements, and Reasonable Accommodation Generally

As a preliminary matter, we note that the EEOC has addressed matters related to pandemic influenza and vaccinations in its technical assistance document entitled Pandemic Preparedness in the Workplace and the Americans with Disabilities Act (2009), http://www.eeoc.gov/facts/pandemic_flu.html, which includes the following questions and answers about mandatory infection control practices, vaccination requirements, and reasonable accommodation for disability under the ADA or religious beliefs under Title VII:

11. During a pandemic, may an employer require its employees to adopt infection-control practices, such as regular hand washing, at the workplace?

Yes. Requiring infection control practices, such as regular hand washing, coughing and sneezing etiquette, and proper tissue usage and disposal, does not implicate the ADA.

12. During a pandemic, may an employer require its employees to wear personal protective equipment (e.g., face masks, gloves, or gowns) designed to reduce the transmission of pandemic infection?

Yes. An employer may require employees to wear personal protective equipment during a pandemic. However, where an employee with a disability needs a related reasonable accommodation under the ADA (e.g., non-latex gloves, or gowns designed for individuals who use wheelchairs), the employer should provide these, absent undue hardship.

Dr. Lee noted that “approximately half of the patients detailed” in her letter have since died. “Those who survived are struggling with long-term sequelae and a diminished quality of life,” she wrote.

No. An employee may be entitled to an exemption from a mandatory vaccination requirement based on an ADA disability that prevents him from taking the influenza vaccine. This would be a reasonable accommodation barring undue hardship (significant difficulty or expense). Similarly, under Title VII of the Civil Rights Act of 1964, once an employer receives notice that an employee’s sincerely held religious belief, practice, or observance prevents him from taking the influenza vaccine, the employer must provide a reasonable accommodation unless it would pose an undue hardship as defined by Title VII (“more than de minimis cost” to the operation of the employer’s business, which is a lower standard than under the ADA).

Generally, ADA-covered employers should consider simply encouraging employees to get the influenza vaccine rather than requiring them to take it.

The Title VII principles referenced in these questions and answers would govern the general questions you have raised regarding whether Title VII requires hospitals to accommodate their employees’ religious objections to receiving influenza and other vaccines, and under what circumstances such accommodation would not be required. Facts relevant to undue hardship in this context would presumably include, among other things, the assessment of the public risk posed at a particular time, the availability of effective alternative means of infection control, and potentially the number of employees who actually request accommodation.

Scope of Covered Religious Beliefs and Employer Inquiries

In your letter, you inquired about what religious beliefs potentially are entitled to accommodation under Title VII, provided that a reasonable accommodation could be provided without undue hardship. The Commission has addressed these matters extensively in the Guidelines on Discrimination Because of Religion, 29 C.F.R. Part 1605, http://www.gpo.gov/fdsys/pkg/CFR-2011-title29-vol4/xml/CFR-2011-title29-vol4-part1605.xml, and the Compliance Manual, Section 12: Religious Discrimination (2008), religion.pdf . The Commission and courts have consistently found that Title VII defines religion very broadly to include not only traditional, organized religions such as Christianity, Judaism, Islam, Hinduism, and Buddhism , but also religious beliefs that are new, uncommon, not part of a formal church or sect, only subscribed to by a small number of people, or that seem illogical or unreasonable to others . An employee’s belief or practice can be “religious” under Title VII even if the employee is affiliated with a religious group that does not espouse or recognize that individual’s belief or practice, or if few – or no – other people adhere to it. Commission Guidelines, 29 C.F.R. § 1605.1 (“ The fact that no religious group espouses such beliefs or the fact that the religious group to which the individual professes to belong may not accept such belief will not determine whether the belief is a religious belief of the employee or prospective employee. “); Compliance Manual at 6-12; Welsh v. United States, 398 U.S. 333, 343 (1970) ( petitioner’s beliefs were religious in nature although the church to which he belonged did not teach those beliefs ); accord Africa v. Commonwealth of Pa., 662 F.2d 1025, 1032-33 (3d Cir.1981); Bushouse v. Local Union 2209, United Auto., Aerospace & Agric. Implement Workers of Am., 164 F. Supp. 2d 1066, 1076 n.15 (N.D. Ind. 2001) (“ Title VII’s intention is to provide protection and accommodation for a broad spectrum of religious practices and belief not merely those beliefs based upon organized or recognized teachings of a particular sect “).

The Compliance Manual further explains that Title VII’s protections also extend to those who are discriminated against or need accommodation because they profess no religious beliefs . Religious beliefs include theistic beliefs (i.e. those that include a belief in God) as well as non-theistic “moral or ethical beliefs as to what is right and wrong which are sincerely held with the strength of traditional religious views. ” Although courts generally resolve doubts about particular beliefs in favor of finding that they are religious, beliefs are not protected merely because they are strongly held. Rather, religion typically concerns “ultimate ideas” about “life, purpose, and death.” Social, political, or economic philosophies, as well as mere personal preferences, are not “religious” beliefs protected by Title VII.

Therefore, whether a practice is religious depends on the employee’s motivation. The same practice might be engaged in by one person for religious reasons and by another person for purely secular reasons (e.g., dietary restrictions, tattoos, etc.). Applying these principles, absent undue hardship, religious accommodation could apply to an applicant or employee with a sincerely held religious belief against vaccination who sought to be excused from the requirement as an accommodation. At the same time, it is unlikely that “religious” beliefs would be held to incorporate secular philosophical opposition to vaccination.

You also asked what steps, if any, hospitals may take to scrutinize a requesting employee’s beliefs to determine whether the employee’s asserted need for accommodation is based on a sincerely held religious belief, and whether hospitals require the requestor to have the support of a religious official. These issues are addressed in great detail, with accompanying examples, in the Compliance Manual, which in pertinent part explains:

Because the definition of religion is broad and protects beliefs and practices with which the employer may be unfamiliar, the employer should ordinarily assume that an employee’s request for religious accommodation is based on a sincerely-held religious belief. If, however, an employee requests religious accommodation, and an employer has an objective basis for questioning either the religious nature or the sincerity of a particular belief or practice, the employer would be justified in seeking additional supporting information.

* * *

When an employer requests additional information, employees should provide information that addresses the employer’s reasonable doubts. That information need not, however, take any specific form. For example, written materials or the employee’s own first-hand explanation may be sufficient to alleviate the employer’s doubts about the sincerity or religious nature of the employee’s professed belief such that third-party verification is unnecessary. Further, since idiosyncratic beliefs can be sincerely held and religious, even when third-party verification is needed, it does not have to come from a church official or member, but rather could be provided by others who are aware of the employee’s religious practice or belief.

An employee who fails to cooperate with an employer’s reasonable request for verification of the sincerity or religious nature of a professed belief risks losing any subsequent claim that the employer improperly denied an accommodation. By the same token, employers who unreasonably request unnecessary or excessive corroborating evidence risk being held liable for denying a reasonable accommodation request, and having their actions challenged as retaliatory or as part of a pattern of harassment.It also is important to remember that even if an employer concludes that an individual’s professed belief is sincerely held and religious, it is only required to grant those requests for accommodation that do not pose an undue hardship on the conduct of its business.

Compliance Manual at pages 12-14, 48-51 (footnotes omitted). See, e.g., Bushouse, 164 F. Supp. 2d 1066, 1078 & n.18 (court held that union’s refusal to provide accommodation unless employee produced independent corroboration that his accommodation request was motivated by a sincerely held religious belief did not violate Title VII’s religious accommodation provision, but cautioned that the holding was limited to “the facts and circumstances of the present case” and that “the inquiry [into sincerity] and scope of that inquiry will necessarily vary based upon the individual requesting corroboration and the facts and circumstances of the request”).

You further inquired whether hospitals may refuse to accommodate an employee’s religious objections to immunizations if, in addition to presenting religious objections to immunizations, the employee submits non-religious, anti-vaccine information. A related matter you have raised is whether a healthcare employee’s receipt of vaccines in the past, in and of itself, relieves an employer of the obligation to accommodate the employee’s present request for religious accommodation. As the Commission has explained:

Like the “religious” nature of a belief or practice, the “sincerity” of an employee’s stated religious belief is usually not in dispute. Nevertheless, there are some circumstances in which an employer may assert as a defense that it was not required to provide accommodation because the employee’s asserted religious belief was not sincerely held. Factors that – either alone or in combination – might undermine an employee’s assertion that he sincerely holds the religious belief at issue include: whether the employee has behaved in a manner markedly inconsistent with the professed belief; whether the accommodation sought is a particularly desirable benefit that is likely to be sought for secular reasons; whether the timing of the request renders it suspect (e.g., it follows an earlier request by the employee for the same benefit for secular reasons); and whether the employer otherwise has reason to believe the accommodation is not sought for religious reasons. However, n one of these factors is dispositive. For example, although prior inconsistent conduct is relevant to the question of sincerity, an individual’s beliefs – or degree of adherence – may change over time, and therefore an employee’s newly adopted or inconsistently observed religious practice may nevertheless be sincerely held. An employer also should not assume that an employee is insincere simply because some of his or her practices deviate from the commonly followed tenets of his or her religion.

Compliance Manual at 13-14 (footnotes omitted). See, e.g., EEOC v. Union Independiente De La Autoridad De Acueductos, 279 F.3d 49, 56-57 & n.8 (1st Cir. 2002) (evidence that Seventh-day Adventist employee had acted in ways inconsistent with the tenets of his religion, for example that he worked five days a week rather than the required six, had lied on an employment application, and took an oath before a notary upon becoming a public employee, can be relevant to the evaluation of sincerity but is not dispositive; the fact that the alleged conflict between plaintiff’s beliefs and union membership kept changing might call into question the sincerity of the beliefs or “ might simply reflect an evolution in plaintiff’s religious views toward a more steadfast opposition to union membership “); Hansard v. Johns-Manville Prods. Corp., 1973 WL 129 (E.D. Tex. Feb. 16, 1973) (employee’s contention that he objected to Sunday work for religious reasons was undermined by his very recent history of Sunday work); see also Hussein v. Waldorf-Astoria, 134 F. Supp. 2d 591 (S.D.N.Y. 2001) (employer had a good faith basis to doubt sincerity of employee’s professed religious need to wear a beard because he had not worn a beard at any time in his fourteen years of employment, had never mentioned his religious beliefs to anyone at the hotel, and simply showed up for work one night and asked for an on-the-spot exception to the no-beard policy), aff’d, 2002 WL 390437 (2d Cir. Mar. 13, 2002) (unpublished); EEOC v. Ilona of Hungary, Inc., 108 F.3d 1569 (7th Cir. 1997) (en banc) (Jewish employee proved her request for leave to observe Yom Kippur was based on a sincerely held religious belief even though she had never in her prior eight-year tenure sought leave from work for a religious observance, and conceded that she generally was not a very religious person; the evidence showed that certain events in her life, including the birth of her son and the death of her father, had strengthened her religious beliefs over the years); Cooper v. Oak Rubber Co., 15 F.3d 1375 (6th Cir. 1994) (that employee had worked the Friday night shift at plant for approximately seven months after her baptism did not establish that she did not hold sincere religious belief against working on Saturdays, considering that 17 months intervened before employee was next required to work on Saturday, and employee’s undisputed testimony was that her faith and commitment to her religion grew during this time); EEOC v. IBP, Inc., 824 F. Supp. 147 (C.D. Ill. 1993) (Seventh-day Adventist employee’s previous absence of faith and subsequent loss of faith did not prove that his religious beliefs were insincere at the time that he refused to work on the Sabbath).

Measures Required in Lieu of Vaccination

You also specifically asked whether an employer that grants a religious accommodation excusing a healthcare worker from a mandatory vaccination may impose additional infection control practices on the worker as a result, such as wearing a mask. While an employer covered by Title VII may not impose such practices for discriminatory or retaliatory reasons, it may do so for legitimate, non-discriminatory and non-retaliatory reasons. Whether the employer’s motivation for imposing additional infection control measures was discriminatory or retaliatory would turn on the facts of a given case.

As you may be aware, specific information is available from the Centers for Disease Control (CDC), at http://www.cdc.gov/flu/healthcareworkers.htm, addressing healthcare workers and vaccination, and the government’s recommendations for particular types of workplaces and other public settings are modified depending upon the assessment of the public risk at a given time. The U.S. Department of Health and Human Services (HHS) has also been actively considering the issue of vaccination for healthcare workers, and what measures to recommend for implementation in hospitals and other settings, and information about these deliberations is available at http://www.hhs.gov/ash/initiatives/hai/tier2_flu.html and related pages on the HHS website. Additional government information and advice for employers, updated on a continuing basis given the assessment of risk at a given time, can be obtained at www.pandemicflu.gov.

Pregnancy

Finally, you asked whether hospitals must accommodate a pregnant employee’s request to refuse vaccines during her pregnancy. We are not aware of any policy guidance or case law directly addressing whether or how Title VII might apply. In general, the Pregnancy Discrimination Act (PDA) forbids discrimination based on pregnancy when it comes to any aspect of employment, including hiring, firing, pay, job assignments, promotions, layoff, training, fringe benefits, such as leave and health insurance, and any other term or condition of employment. In the scenario you pose, a pregnant employee might allege disparate treatment under the PDA and/or Title VII if an employer refused to excuse the pregnant employee from a vaccination requirement but permitted non-pregnant or male employees to be excused from the requirement on other grounds, such as having a medical condition that was a contra-indicator for the vaccination. The outcome of such a claim would obviously turn on the facts of the particular case. Cf. Armstrong v. Flowers Hospital, Inc., 33 F.3d 1308 (11th Cir. 1994) (affirming summary judgment for employer on claims by pregnant nurse that she was subjected to disparate treatment or disparate impact in violation of the PDA when the employer denied her request to be excused during pregnancy from treating patients with AIDS; accommodation sought would have amounted to preferential treatment because no comparable employees were excused from the requirement to treat all patients).

Additionally, although you have confined your inquiry to Title VII, we note that impairments resulting from pregnancy (for example, gestational diabetes or preeclampsia, a condition characterized by pregnancy-induced hypertension and protein in the urine) may be disabilities under the Americans with Disabilities Act (ADA), as amended. An employer may have to provide a reasonable accommodation (such as leave or modifications that enable an employee to perform her job) for a disability related to pregnancy, absent undue hardship (significant difficulty or expense under the ADA). The ADA Amendments Act of 2008 makes it much easier to show that a medical condition is a covered disability. For more information about the ADA, see http://www.eeoc.gov/laws/types/disability.cfm. For information about the ADA Amendments Act of 2008, and the EEOC’s implementing regulations, see http://www.eeoc.gov/laws/statutes/adaaa_info.cfm.

I hope this information is helpful. This has been an informal discussion of the issues you raised and does not constitute an official opinion of the Equal Employment Opportunity Commission.

Sincerely,

/s/

Peggy R. Mastroianni

Legal Counsel

This page was last modified on April 6, 2012.

29 CFR 1605

https://www.govinfo.gov/content/pkg/CFR-2011-title29-vol4/xml/CFR-2011-title29-vol4-part1605.xml

Code of Federal Regulations

Pt. 1605PART 1605—GUIDELINES ON DISCRIMINATION BECAUSE OF RELIGIONSec.1605.1“Religious” nature of a practice or belief.1605.2Reasonable accommodation without undue hardship as required by section 701(j) of title VII of the Civil Rights Act of 1964.1605.3Selection practices.Appendix A to §§ 1605.2 and 1605.3—Background InformationAuthority:Title VII of the Civil Rights Act of 1964, as amended, 42 U.S.C. 2000e et seq.Source:45 FR 72612, Oct. 31, 1980, unless otherwise noted.§ 1605.1“Religious” nature of a practice or belief.In most cases whether or not a practice or belief is religious is not at issue. However, in those cases in which the issue does exist, the Commission will define religious practices to include moral or ethical beliefs as to what is right and wrong which are sincerely held with the strength of traditional religious views. This standard was developed in United States v. Seeger, 380 U.S. 163 (1965) and Welsh v. United States, 398 U.S. 333 (1970). The Commission has consistently applied this standard in its decisions. 1 The fact that no religious group espouses such beliefs or the fact that the religious group to which the individual professes to belong may not accept such belief will not determine whether the belief is a religious belief of the employee or prospective employee. The phrase “religious practice” as used in these Guidelines includes both religious observances and practices, as stated in section 701(j), 42 U.S.C. 2000e(j).

Footnote(s):1 See CD 76-104 (1976), CCH ¶ 6500; CD 71-2620 (1971), CCH ¶ 6283; CD 71-779 (1970), CCH ¶ 6180.

§ 1605.2Reasonable accommodation without undue hardship as required by section 701(j) of title VII of the Civil Rights Act of 1964.(a) Purpose of this section. This section clarifies the obligation imposed by title VII of the Civil Rights Act of 1964, as amended, (sections 701(j), 703 and 717) to accommodate the religious practices of employees and prospective employees. This section does not address other obligations under title VII not to discriminate on grounds of religion, nor other provisions of title VII. This section is not intended to limit any additional obligations to accommodate religious practices which may exist pursuant to constitutional, or other statutory provisions; neither is it intended to provide guidance for statutes which require accommodation on bases other than religion such as section 503 of the Rehabilitation Act of 1973. The legal principles which have been developed with respect to discrimination prohibited by title VII on the bases of race, color, sex, and national origin also apply to religious discrimination in all circumstances other than where an accommodation is required. (b) Duty to accommodate. (1) Section 701(j) makes it an unlawful employment practice under section 703(a)(1) for an employer to fail to reasonably accommodate the religious practices of an employee or prospective employee, unless the employer demonstrates that accommodation would result in undue hardship on the conduct of its business. 2

Footnote(s):2 See Trans World Airlines, Inc. v. Hardison, 432 U.S. 63, 74 (1977).

(2) Section 701(j) in conjunction with section 703(c), imposes an obligation on a labor organization to reasonably accommodate the religious practices of an employee or prospective employee, unless the labor organization demonstrates that accommodation would result in undue hardship. (3) Section 1605.2 is primarily directed to obligations of employers or labor organizations, which are the entities covered by title VII that will most often be required to make an accommodation. However, the principles of § 1605.2 also apply when an accommodation can be required of other entities covered by title VII, such as employment agencies (section 703(b)) or joint labor-management committees controlling apprecticeship or other training or retraining (section 703(d)). (See, for example, § 1605.3(a) “Scheduling of Tests or Other Selection Procedures.”)(c) Reasonable accommodation. (1) After an employee or prospective employee notifies the employer or labor organization of his or her need for a religious accommodation, the employer or labor organization has an obligation to reasonably accommodate the individual’s religious practices. A refusal to accommodate is justified only when an employer or labor organization can demonstrate that an undue hardship would in fact result from each available alternative method of accommodation. A mere assumption that many more people, with the same religious practices as the person being accommodated, may also need accommodation is not evidence of undue hardship.(2) When there is more than one method of accommodation available which would not cause undue hardship, the Commission will determine whether the accommodation offered is reasonable by examining:(i) The alternatives for accommodation considered by the employer or labor organization; and(ii) The alternatives for accommodation, if any, actually offered to the individual requiring accommodation. Some alternatives for accommodating religious practices might disadvantage the individual with respect to his or her employment opportunites, such as compensation, terms, conditions, or privileges of employment. Therefore, when there is more than one means of accommodation which would not cause undue hardship, the employer or labor organization must offer the alternative which least disadvantages the individual with respect to his or her employment opportunities. (d) Alternatives for accommodating religious practices. (1) Employees and prospective employees most frequently request an accommodation because their religious practices conflict with their work schedules. The following subsections are some means of accommodating the conflict between work schedules and religious practices which the Commission believes that employers and labor organizations should consider as part of the obligation to accommodate and which the Commission will consider in investigating a charge. These are not intended to be all-inclusive. There are often other alternatives which would reasonably accommodate an individual’s religious practices when they conflict with a work schedule. There are also employment practices besides work scheduling which may conflict with religious practices and cause an individual to request an accommodation. See, for example, the Commission’s finding number (3) from its Hearings on Religious Discrimination, in appendix A to §§ 1605.2 and 1605.3. The principles expressed in these Guidelines apply as well to such requests for accommodation.(i) Voluntary Substitutes and “Swaps”. Reasonable accommodation without undue hardship is generally possible where a voluntary substitute with substantially similar qualifications is available. One means of substitution is the voluntary swap. In a number of cases, the securing of a substitute has been left entirely up to the individual seeking the accommodation. The Commission believes that the obligation to accommodate requires that employers and labor organizations facilitate the securing of a voluntary substitute with substantially similar qualifications. Some means of doing this which employers and labor organizations should consider are: to publicize policies regarding accommodation and voluntary substitution; to promote an atmosphere in which such substitutions are favorably regarded; to provide a central file, bulletin board or other means for matching voluntary substitutes with positions for which substitutes are needed.(ii) Flexible Scheduling.One means of providing reasonable accommodation for the religious practices of employees or prospective employees which employers and labor organizations should consider is the creation of a flexible work schedule for individuals requesting accommodation. The following list is an example of areas in which flexibility might be introduced: flexible arrival and departure times; floating or optional holidays; flexible work breaks; use of lunch time in exchange for early departure; staggered work hours; and permitting an employee to make up time lost due to the observance of religious practices. example of areas in which flexibility might be introduced: flexible arrival and departure times; floating or optional holidays; flexible work breaks; use of lunch time in exchange for early departure; staggered work hours; and permitting an employee to make up time lost due to the observance of religious practices. 3

Footnote(s):3 On September 29, 1978, Congress enacted such a provision for the accommodation of Federal employees’ religious practices. See Pub. L. 95-390, 5 U.S.C. 5550a “Compensatory Time Off for Religious Observances.”

(iii) Lateral Transfer and Change of Job Assignments. When an employee cannot be accommodated either as to his or her entire job or an assignment within the job, employers and labor organizations should consider whether or not it is possible to change the job assignment or give the employee a lateral transfer.(2) Payment of Dues to a Labor Organization. Some collective bargaining agreements include a provision that each employee must join the labor organization or pay the labor organization a sum equivalent to dues. When an employee’s religious practices to not permit compliance with such a provision, the labor organization should accommodate the employee by not requiring the employee to join the organization and by permitting him or her to donate a sum equivalent to dues to a charitable organization.(e) Undue hardship. (1) Cost. An employer may assert undue hardship to justify a refusal to accommodate an employee’s need to be absent from his or her scheduled duty hours if the employer can demonstrate that the accommodation would require “more than a de minimis cost” . 4 The Commission will determine what constitutes “more than a de minimis cost” with due regard given to the identifiable cost in relation to the size and operating cost of the employer, and the number of individuals who will in fact need a particular accommodation. In general, the Commission interprets this phrase as it was used in the Hardison decision to mean that costs similar to the regular payment of premium wages of substitutes, which was at issue in Hardison, would constitute undue hardship. However, the Commission will presume that the infrequent payment of premium wages for a substitute or the payment of premium wages while a more permanent accommodation is being sought are costs which an employer can be required to bear as a means of providing a reasonable accommodation. Further, the Commission will presume that generally, the payment of administrative costs necessary for providing the accommodation will not constitute more than a de minimis cost. Administrative costs, for example, include those costs involved in rearranging schedules and recording substitutions for payroll purposes.

Footnote(s):4 Hardison, supra, 432 U.S. at 84.

(2) Seniority Rights. Undue hardship would also be shown where a variance from a bona fide seniority system is necessary in order to accommodate an employee’s religious practices when doing so would deny another employee his or her job or shift preference guaranteed by that system. Hardison, supra, 432 U.S. at 80. Arrangements for voluntary substitutes and swaps (see paragraph (d)(1)(i) of this section) do not constitute an undue hardship to the extent the arrangements do not violate a bona fide seniority system. Nothing in the Statute or these Guidelines precludes an employer and a union from including arrangements for voluntary substitutes and swaps as part of a collective bargaining agreement.§ 1605.3Selection practices.(a) Scheduling of tests or other selection procedures. When a test or other selection procedure is scheduled at a time when an employee or prospective employee cannot attend because of his or her religious practices, the user of the test should be aware that the principles enunciated in these guidelines apply and that it has an obligation to accommodate such employee or prospective employee unless undue hardship would result.(b) Inquiries which determine an applicant’s availability to work during an employer’s scheduled working hours. (1) The duty to accommodate pertains to prospective employees as well as current employees. Consequently, an employer may not permit an applicant’s need for a religious accommodation to affect in any way its decision whether to hire the applicant unless it can demonstrate that it cannot reasonably accommodate the applicant’s religious practices without undue hardship.(2) As a result of the oral and written testimony submitted at the Commission’s Hearings on Religious Discrimination, discussions with representatives of organizations interested in the issue of religious discrimination, and the comments received from the public on these Guidelines as proposed, the Commission has concluded that the use of pre-selection inquiries which determine an applicant’s availability has an exclusionary effect on the employment opportunities of persons with certain religious practices. The use of such inquiries will, therefore, be considered to violate title VII unless the employer can show that it:(i) Did not have an exclusionary effect on its employees or prospective employees needing an accommodation for the same religious practices; or(ii) Was otherwise justified by business necessity. Employers who believe they have a legitimate interest in knowing the availability of their applicants prior to selection must consider procedures which would serve this interest and which would have a lesser exclusionary effect on persons whose religious practices need accommodation. An example of such a procedure is for the employer to state the normal work hours for the job and, after making it clear to the applicant that he or she is not required to indicate the need for any absences for religious practices during the scheduled work hours, ask the applicant whether he or she is otherwise available to work those hours. Then, after a position is offered, but before the applicant is hired, the employer can inquire into the need for a religious accommodation and determine, according to the principles of these Guidelines, whether an accommodation is possible. This type of inquiry would provide an employer with information concerning the availability of most of its applicants, while deferring until after a position is offered the identification of the usually small number of applicants who require an accommodation.(3) The Commission will infer that the need for an accommodation discriminatorily influenced a decision to reject an applicant when: (i) prior to an offer of employment the employer makes an inquiry into an applicant’s availability without having a business necessity justification; and (ii) after the employer has determined the applicant’s need for an accommodation, the employer rejects a qualified applicant. The burden is then on the employer to demonstrate that factors other than the need for an accommodation were the reason for rejecting the qualified applicant, or that a reasonable accommodation without undue hardship was not possible.§§ 1605.2 &1605.3, App. A Appendix A to §§ 1605.2 and 1605.3—Background Information In 1966, the Commission adopted guidelines on religious discrimination which stated that an employer had an obligation to accommodate the religious practices of its employees or prospective employees unless to do so would create a “serious inconvenience to the conduct of the business” . 29 CFR 1605.1(a)(2), 31 FR 3870 (1966).

In 1967, the Commission revised these guidelines to state that an employer had an obligation to reasonably accommodate the religious practices of its employees or prospective employees, unless the employer could prove that to do so would create an “undue hardship” . 29 CFR 1605.1(b)(c), 32 FR 10298.In 1972, Congress amended title VII to incorporate the obligation to accommodate expressed in the Commission’s 1967 Guidelines by adding section 701(j).In 1977, the United States Supreme Court issued its decision in the case of Trans World Airlines, Inc. v. Hardison, 432 U.S. 63 (1977). Hardison was brought under section 703(a)(1) because it involved facts occurring before the enactment of section 701(j). The Court applied the Commission’s 1967 Guidelines, but indicated that the result would be the same under section 701(j). It stated that Trans World Airlines had made reasonable efforts to accommodate the religious needs of its employee, Hardison. The Court held that to require Trans World Airlines to make further attempts at accommodations—by unilaterally violating a seniority provision of the collective bargaining agreement, paying premium wages on a regular basis to another employee to replace Hardison, or creating a serious shortage of necessary employees in another department in order to replace Hardison—would create an undue hardship on the conduct of Trans World Airlines’ business, and would therefore, exceed the duty to accommodate Hardison.In 1978, the Commission conducted public hearings on religious discrimination in New York City, Milwaukee, and Los Angeles in order to respond to the concerns raised by Hardison. Approximately 150 witnesses testified or submitted written statements. 5 The witnesses included employers, employees, representatives of religious and labor organizations and representatives of Federal, State and local governments.

Footnote(s):5 The transcript of the Commission’s Hearings on Religious Discrimination can be examined by the public at: The Equal Employment Opportunity Commission, 131 M Street, NE., Washington, DC 20507.

The Commission found from the hearings that:(1) There is widespread confusion concerning the extent of accommodation under the Hardison decision.(2) The religious practices of some individuals and some groups of individuals are not being accommodated.(3) Some of those practices which are not being accommodated are:—Observance of a Sabbath or religious holidays;—Need for prayer break during working hours;—Practice of following certain dietary requirements;—Practice of not working during a mourning period for a deceased relative;—Prohibition against medical examinations;—Prohibition against membership in labor and other organizations; and—Practices concerning dress and other personal grooming habits.(4) Many of the employers who testified had developed alternative employment practices which accommodate the religious practices of employees and prospective employees and which meet the employer’s business needs.(5) Little evidence was submitted by employers which showed actual attempts to accommodate religious practices with resultant unfavorable consequences to the employer’s business. Employers appeared to have substantial anticipatory concerns but no, or very little, actual experience with the problems they theorized would emerge by providing reasonable accommodation for religious practices. Based on these findings, the Commission is revising its Guidelines to clarify the obligation imposed by section 701(j) to accommodate the religious practices of employees and prospective employees.[45 FR 72612, Oct. 31, 1980, as amended at 74 FR 3430, Jan. 21, 2009]

EEOC Compliance Manual

religionU.S. Court of Appeals for the Sixth Circuit in Cincinnati, Ohio Rules in Favor of Student Athletes at Western Michigan University

This look VERY promising…

Order-Denying-Motion-for-Stay-COA-WMU-1Articles

Dr. Reiner Fuellmich

-

Rand Paul Says Resist COVID Medical Tyranny

https://www.bitchute.com/video/lzQPEwbfEvol/Continue reading »

-

Immunologist gives testimony to Indiana School District – CDC ineffective, masks don’t work, use Ivermectin (repurposed drugs)

https://rumble.com/embed/vicn8p/?pub=5zpyl [sc name="fullarticle" ]https://rumble.com/vkytdz-medical-expert-annihilates-school-board-over-unscientific-mask-mandates.html[/sc]Continue reading »

-

Number of Deaths Reported After COVID Vaccines Jumps by More Than 2,000 in 1 Week, According to VAERS

https://childrenshealthdefense.org/defender/cdc-vaers-deaths-reported-covid-vaccines/?utm_source=salsa&eType=EmailBlastContent&eId=7fa4238d-0294-400f-b083-ed7320af3dc7Continue reading »

-

Dr. Fauci Predicted a Pandemic Under Trump in 2017

https://www.youtube.com/watch?v=puqaaeLnEww “And if there’s one message that I want to leave with you today based on my experience … is…Continue reading »

-

Navy Doctor Persecuted by Biden Era DOJ For Injecting With Saline

[sc name="sourcelink" ]https://revolver.news/2025/07/mtg-throws-hail-mary-for-navy-doc-facing-life-in-prison-for-saying-no-to-bidens-vax-madness/[/sc] During some of the darkest days in American history, when COVID fear ruled the airwaves and mandates…Continue reading »

-

Charlene Carter’s (Southwest Airlines flight attendant) Religious Freedom Case

Read the court case: [pdf-embedder url="https://mymedicalfreedom.org/wp-content/uploads/2025/07/Charline-Carter-court-case.pdf" title="Charline Carter court case"] Download PDF A Grok summary which may contain errors: ###…Continue reading »

-

Stephen Colbert’s Vomit-Inducing “The Vax-Scene” (Remastered to 4K/60fps)

RumbleContinue reading »

-

Dr. Patrick Soon-Shiong: You’re Being Lied to About Cancer, How It’s Caused, and How to Stop It

on RumbleContinue reading »

-

Airline Employees 4 Health Freedom

[sc name="sourcelink" ]https://aerocrewnews.com/2025/03/01/airline-employees-4-health-freedom/[/sc] By Capt. Laura Cox - March 1, 2025 Written by: Capt. Laura Cox and Capt. Sherry Walker…Continue reading »

-

Norway Sounds Alarm as Scientists Link Covid ‘Vaccines’ to Global Death Surge

[sc name="sourcelink" ]https://slaynews.com/news/norway-sounds-alarm-scientists-link-covid-vaccines-global-death-surge/[/sc] Frank Bergman February 6, 2025 - 12:58 pm A group of leading scientists in Norway is sounding…Continue reading »

-

BOMBSHELL: Co-Founder and CEO of BioNTech Refuses to Take the mRNA Covid Vaccine Because He says, “We Need to Ensure Functionality of Our Whole Company”

[sc name="sourcelink" ]https://www.infowars.com/posts/bombshell-co-founder-and-ceo-of-biontech-refuses-to-take-the-mrna-covid-vaccine-because-he-says-we-need-to-ensure-functionality-of-our-whole-company[/sc] by S.D. Wells | Natural NewsJanuary 8th, 2025 7:01 AM Imagine if an automobile manufacturer recommended their…Continue reading »

-

IVERMECTIN and CANCER, it has at least 15 anti-cancer mechanisms of action. Can Ivermectin Treat COVID-19 mRNA Vaccine Induced Turbo Cancers? – 9 Ivermectin papers reviewed

[sc name="sourcelink" ]https://makismd.substack.com/p/ivermectin-and-cancer-it-has-at-least[/sc] Dr. William Makis MD Oct 02, 2023 ∙ Paid Papers reviewed: 2023 Sep.23 - Man-Yuan Li et al -…Continue reading »

-

Fenbendazole Cancer Success Stories: 83 Case Reports Compilation (January 2025 Edition)

[sc name="sourcelink" ]https://www.onedaymd.com/2024/02/fenbendazole-cancer-success-stories.html[/sc] [pdf-embedder url="https://mymedicalfreedom.org/wp-content/uploads/2025/01/Fenbendazole-Cancer-Success-Stories_-83-Case-Reports-Compilation-January-2025-Edition.pdf" title="Fenbendazole Cancer Success Stories_ 83 Case Reports Compilation (January 2025 Edition)"]Continue reading »

-

U.S. House of Representatives Report on Coronavirus Pandemic

[sc name="sourcelink" ]https://oversight.house.gov/wp-content/uploads/2024/12/2024.12.04-SSCP-FINAL-REPORT-ANS.pdf[/sc] [pdf-embedder url="https://mymedicalfreedom.org/wp-content/uploads/2025/01/2024.12.04-SSCP-FINAL-REPORT-ANS.pdf"]Continue reading »

Further Readings

You have the right to make your own medical choices

sources:

- Horowitz: Trump-appointed judge implies no right to bodily autonomy in Indiana vaccine lawsuit

- Horowitz: Why Dershowitz is wrong to apply Jacobson decision in support of vaccine passports

- Cruzan v. Director, Missouri Department of Health (1990)

- SCOTUS: “ Every human being of adult years and sound mind has a right to determine what shall be done with his own body, and a surgeon who performs an operation without his patient’s consent commits an assault, for which he is liable in damages.” Before the turn of the century, this Court observed that “[n]o right is held more sacred, or is more carefully guarded, by the common law, than the right of every individual to the possession and control of his own person, free from all restraint or interference of others, unless by clear and unquestionable authority of law. ” Union Pacific R. Co. v. Botsford, 141 U.S. 250, 251, 11 S.Ct. 1000, 1001, 35 L.Ed. 734 (1891).

- This notion of bodily integrity has been embodied in the requirement that informed consent is generally required for medical treatment. Justice Cardozo, while on the Court of Appeals of New York, aptly described this doctrine: “Every human being of adult years and sound mind has a right to determine what shall be done with his own body; and a surgeon who performs an operation without his patient’s consent commits an assault, for which he is liable in damages.” Schloendorff v. Society of New York Hospital, 211 N.Y. 125, 129-130, 105 N.E. 92, 93 (1914).

- In Union Pacific Railway Co. v. Botsford, Justice Gray noted, “The right to one’s person may be said to be a right of complete immunity; to be let alone,” which implies that there is virtually nothing a state can do against one’s body even with strong arguments and science to back it up. (opinion article: Horowitz: Trump-appointed judge implies no right to bodily autonomy in Indiana vaccine lawsuit)

Calder v. Bull (1798)

- SCOTUS: a legislature cannot go so far as to violate natural law even if the “authority should not be expressly restrained by the constitution or fundamental law of the state.”

- Chief Justice Samuel Chase stated: “An act of the legislature (for I cannot call it a law) contrary to the great first principles of the social compact cannot be considered a rightful exercise of legislative authority.”

- “To maintain that our federal or state legislature possesses such powers if it had not been expressly restrained would, in my opinion, be a political heresy altogether inadmissible in our free republican governments.”

- mask mandates going on indefinitely forever for children to obtain an education or for humans to live a free life is the ultimate form of ex post facto “law,” which was defined in Calder v. Bull as making “an action done before the passing of the law, and which was innocent when done, criminal.”

California health department’s rule banning home-based group worship or Bible study during COVID

- SCOTUS: “The government has the burden to establish that the challenged law satisfies strict scrutiny,” wrote the unsigned order. “To do so in this context, it must do more than assert that certain risk factors ‘are always present in worship, or always absent from the other secular activities’ the government may allow.”

- https://mymedicalfreedom.org/wp-content/uploads/2021/08/20a151_4g15.pdf

Tanton v. Newsom

- Supreme Court overturns California’s denial of religious gatherings based on violation of the “strict scrutiny” requirement.

- PDF: https://mymedicalfreedom.org/wp-content/uploads/2021/08/Tanton-v.-Newsom.pdf

Public Readiness and Emergency Preparedness (PREP) Act

The Public Readiness and Emergency Preparedness Act (PREP Act) authorizes the Secretary of the Department of Health and Human Services (Secretary) to issue a PREP Act declaration. The declaration provides immunity from liability (except for willful misconduct) for claims:

- of loss caused, arising out of, relating to, or resulting from administration or use of countermeasures to diseases, threats and conditions

- determined by the Secretary to constitute a present, or credible risk of a future public health emergency

- to entities and individuals involved in the development, manufacture, testing, distribution, administration, and use of such countermeasures

A PREP Act declaration is specifically for the purpose of providing immunity from liability, and is different from, and not dependent on, other emergency declarations.

ACTION:

Notice of declaration.

SUMMARY:

The Secretary is issuing this Declaration pursuant to section 319F-3 of the Public Health Service Act to provide liability immunity for activities related to medical countermeasures against COVID-19 .

DATES:

The Declaration was effective as of to provide liability immunity for activities related to medical countermeasures against COVID-19 .

FOR FURTHER INFORMATION CONTACT:

Robert P. Kadlec, MD, MTM&H, MS, Assistant Secretary for Preparedness and Response, Office of the Secretary, Department of Health and Human Services, 200 Independence Avenue SW, Washington, DC 20201; Telephone: 202-205-2882.

SUPPLEMENTARY INFORMATION:

The Public Readiness and Emergency Preparedness Act (PREP Act) authorizes the Secretary of Health and Human Services (the Secretary) to issue a Declaration to provide liability immunity to certain individuals and entities (Covered Persons) against any claim of loss caused by, arising out of, relating to, or resulting from the manufacture, distribution, administration, or use of medical countermeasures (Covered Countermeasures), except for claims involving “willful misconduct” as defined in the PREP Act. This Declaration is subject to amendment as circumstances warrant.

The PREP Act was enacted on December 30, 2005, as Public Law 109-148, Division C, Section 2. It amended the Public Health Service (PHS) Act, adding Section 319F-3, which addresses liability immunity, and Section 319F-4, which creates a compensation program. These sections are codified at 42 U.S.C. 247d-6d and 42 U.S.C. 247d-6e, respectively.

The Pandemic and All-Hazards Preparedness Reauthorization Act (PAHPRA), Public Law 113-5, was enacted on March 13, 2013. Among other things, PAHPRA added sections 564A and 564B to the Federal Food, Drug, and Cosmetic (FD&C) Act to provide new authorities for the emergency use of approved products in emergencies and products held for emergency use. PAHPRA accordingly amended the definitions of “Covered Countermeasures” and “qualified pandemic and epidemic products” in Section 319F-3 of the Public Health Service Act (PREP Act provisions), so that products made available under these new FD&C Act authorities could be covered under PREP Act Declarations. PAHPRA also extended the definition of qualified pandemic and epidemic products that may be covered under a PREP Act Declaration to include products or technologies intended to enhance the use or effect of a drug, biological product, or device used against the pandemic or epidemic or against adverse events from these products.

COVID-19 is an acute respiratory disease caused by the SARS-CoV-2 betacoronavirus or a virus mutating therefrom. This virus is similar to other betacoronaviruses, such as Middle Eastern Respiratory Syndrome (MERS) and Severe Acute Respiratory Syndrome (SARS). Although the complete clinical picture regarding SARS-CoV-2 or a virus mutating therefrom is not fully understood, the virus has been known to cause severe respiratory illness and death in a subset of those people infected with such virus(es).

In December 2019, the novel coronavirus was detected in Wuhan City, Hubei Province, China. Today, over 101 countries, including the United States have reported multiple cases. Acknowledging that cases had been reported in five WHO regions in one month, on January 30, 2020, WHO declared the COVID-19 outbreak to be a Public Health Emergency of International Concern (PHEIC) following a second meeting of the Emergency Committee convened under the International Health Regulations (IHR).

To date, United States traveler-associated cases have been identified in a number of States and community-based transmission is suspected. On January 31, 2020, Secretary Azar declared a public health emergency pursuant to section 319 of the PHS Act, 42 U.S.C. 247d, for the entire United States to aid in the nation’s health care community response to the COVID-19 outbreak.[1] The outbreak remains a significant public health challenge that requires a sustained, coordinated proactive response by the Government in order to contain and mitigate the spread of COVID-19.[2]

Description of This Declaration by Section

Section I. Determination of Public Health Emergency or Credible Risk of Future Public Health Emergency

Before issuing a Declaration under the PREP Act, the Secretary is required to determine that a disease or other health condition or threat to health constitutes a public health emergency or that there is a credible risk that the disease, condition, or threat may constitute such an emergency. This determination is separate and apart from the Declaration issued by the Secretary on January 31, 2020 under Section 319 of the PHS Act that a disease or disorder presents a public health emergency or that a public health emergency, including significant outbreaks of infectious diseases or bioterrorist attacks, otherwise exists, or other Declarations or determinations made under other authorities of the Secretary. Accordingly in Section I of the Declaration, the Secretary determines that the spread of SARS-CoV-2 or a virus mutating therefrom and the resulting disease, COVID-19, constitutes a public health emergency for purposes of this Declaration under the PREP Act.

Section II. Factors Considered by the Secretary

In deciding whether and under what circumstances to issue a Declaration with respect to a Covered Countermeasure, the Secretary must consider the desirability of encouraging the design, development, clinical testing or investigation, manufacture, labeling, distribution, formulation, packaging, marketing, promotion, sale, purchase, donation, dispensing, prescribing, administration, licensing, and use of the countermeasure. In Section II of the Declaration, the Secretary states that he has considered these factors.

Section III. Activities Covered by This Declaration Under the PREP Act’s Liability Immunity

The Secretary must delineate the activities for which the PREP Act’s liability immunity is in effect. These activities may include, under conditions as the Secretary may specify, the manufacture, testing, development, distribution, administration, or use of one or more Covered Countermeasures Start Printed Page 15199(Recommended Activities). In Section III of the Declaration, the Secretary sets out the activities for which the immunity is in effect.

Section IV. Limited Immunity

The Secretary must also state that liability protections available under the PREP Act are in effect with respect to the Recommended Activities. These liability protections provide that, “[s]ubject to other provisions of [the PREP Act], a covered person shall be immune from suit and liability under federal and state law with respect to all claims for loss caused by, arising out of, relating to, or resulting from the administration to or use by an individual of a covered countermeasure if a Declaration has been issued with respect to such countermeasure.” In Section IV of the Declaration, the Secretary states that liability protections are in effect with respect to the Recommended Activities.

Section V. Covered Persons

Section V of the Declaration describes Covered Persons, including Qualified Persons. The PREP Act defines Covered Persons to include, among others, the United States, and those that manufacturer, distribute, administer, prescribe or use Covered Countermeasures. This Declaration includes all persons and entities defined as Covered Persons under the PREP Act (PHS Act 317F-3(i)(2)) as well as others set out in paragraphs (3), (4), (6), (8)(A) and (8)(B).

The PREP Act’s liability immunity applies to “Covered Persons” with respect to administration or use of a Covered Countermeasure. The term “Covered Persons” has a specific meaning and is defined in the PREP Act to include manufacturers, distributors, program planners, and qualified persons, and their officials, agents, and employees, and the United States. The PREP Act further defines the terms “manufacturer,” “distributor,” “program planner,” and “qualified person” as described below.

A manufacturer includes a contractor or subcontractor of a manufacturer; a supplier or licenser of any product, intellectual property, service, research tool or component or other article used in the design, development, clinical testing, investigation or manufacturing of a Covered Countermeasure; and any or all the parents, subsidiaries, affiliates, successors, and assigns of a manufacturer.

A distributor means a person or entity engaged in the distribution of drugs, biologics, or devices, including but not limited to: Manufacturers; re-packers; common carriers; contract carriers; air carriers; own-label distributors; private-label distributors; jobbers; brokers; warehouses and wholesale drug warehouses; independent wholesale drug traders; and retail pharmacies.

A program planner means a state or local government, including an Indian tribe; a person employed by the state or local government; or other person who supervises or administers a program with respect to the administration, dispensing, distribution, provision, or use of a Covered Countermeasure, including a person who establishes requirements, provides policy guidance, or supplies technical or scientific advice or assistance or provides a facility to administer or use a Covered Countermeasure in accordance with the Secretary’s Declaration. Under this definition, a private sector employer or community group or other “person” can be a program planner when it carries out the described activities.

A qualified person means a licensed health professional or other individual authorized to prescribe, administer, or dispense Covered Countermeasures under the law of the state in which the Covered Countermeasure was prescribed, administered, or dispensed; or a person within a category of persons identified as qualified in the Secretary’s Declaration. Under this definition, the Secretary can describe in the Declaration other qualified persons, such as volunteers, who are Covered Persons. Section V describes other qualified persons covered by this Declaration.

The PREP Act also defines the word “person” as used in the Act: A person includes an individual, partnership, corporation, association, entity, or public or private corporation, including a federal, state, or local government agency or department.

Section VI. Covered Countermeasures

As noted above, Section III of the Declaration describes the activities (referred to as “Recommended Activities”) for which liability immunity is in effect. Section VI of the Declaration identifies the Covered Countermeasures for which the Secretary has recommended such activities. The PREP Act states that a “Covered Countermeasure” must be a “qualified pandemic or epidemic product,” or a “security countermeasure,” as described immediately below; or a drug, biological product or device authorized for emergency use in accordance with Sections 564, 564A, or 564B of the FD&C Act.

A qualified pandemic or epidemic product means a drug or device, as defined in the FD&C Act or a biological product, as defined in the PHS Act that is (i) manufactured, used, designed, developed, modified, licensed or procured to diagnose, mitigate, prevent, treat, or cure a pandemic or epidemic or limit the harm such a pandemic or epidemic might otherwise cause; (ii) manufactured, used, designed, developed, modified, licensed, or procured to diagnose, mitigate, prevent, treat, or cure a serious or life-threatening disease or condition caused by such a drug, biological product, or device; (iii) or a product or technology intended to enhance the use or effect of such a drug, biological product, or device.

A security countermeasure is a drug or device, as defined in the FD&C Act or a biological product, as defined in the PHS Act that (i)(a) The Secretary determines to be a priority to diagnose, mitigate, prevent, or treat harm from any biological, chemical, radiological, or nuclear agent identified as a material threat by the Secretary of Homeland Security, or (b) to diagnose, mitigate, prevent, or treat harm from a condition that may result in adverse health consequences or death and may be caused by administering a drug, biological product, or device against such an agent; and (ii) is determined by the Secretary of Health and Human Services to be a necessary countermeasure to protect public health.

To be a Covered Countermeasure, qualified pandemic or epidemic products or security countermeasures also must be approved or cleared under the FD&C Act; licensed under the PHS Act; or authorized for emergency use under Sections 564, 564A, or 564B of the FD&C Act.

A qualified pandemic or epidemic product also may be a Covered Countermeasure when it is subject to an exemption (that is, it is permitted to be used under an Investigational Drug Application or an Investigational Device Exemption) under the FD&C Act and is the object of research for possible use for diagnosis, mitigation, prevention, treatment, or cure, or to limit harm of a pandemic or epidemic or serious or life-threatening condition caused by such a drug or device.

A security countermeasure also may be a Covered Countermeasure if it may reasonably be determined to qualify for approval or licensing within 10 years after the Department’s determination that procurement of the countermeasure is appropriate.

Section VI lists medical countermeasures against COVID-19 that Start Printed Page 15200are Covered Countermeasures under this declaration.

Section VI also refers to the statutory definitions of Covered Countermeasures to make clear that these statutory definitions limit the scope of Covered Countermeasures. Specifically, the Declaration notes that Covered Countermeasures must be “qualified pandemic or epidemic products,” or “security countermeasures,” or drugs, biological products, or devices authorized for investigational or emergency use, as those terms are defined in the PREP Act, the FD&C Act, and the Public Health Service Act.

Section VII. Limitations on Distribution

The Secretary may specify that liability immunity is in effect only to Covered Countermeasures obtained through a particular means of distribution. The Declaration states that liability immunity is afforded to Covered Persons for Recommended Activities related to (a) present or future federal contracts, cooperative agreements, grants, other transactions, interagency agreements, or memoranda of understanding or other federal agreements; or (b) activities authorized in accordance with the public health and medical response of the Authority Having Jurisdiction to prescribe, administer, deliver, distribute, or dispense the Covered Countermeasures following a Declaration of an emergency.

Section VII defines the terms “Authority Having Jurisdiction” and “Declaration of an emergency.” We have specified in the definition that Authorities having jurisdiction include federal, state, local, and tribal authorities and institutions or organizations acting on behalf of those governmental entities.

For governmental program planners only, liability immunity is afforded only to the extent they obtain Covered Countermeasures through voluntary means, such as (1) donation; (2) commercial sale; (3) deployment of Covered Countermeasures from federal stockpiles; or (4) deployment of donated, purchased, or otherwise voluntarily obtained Covered Countermeasures from state, local, or private stockpiles. This last limitation on distribution is intended to deter program planners that are government entities from seizing privately held stockpiles of Covered Countermeasures. It does not apply to any other Covered Persons, including other program planners who are not government entities.

Section VIII. Category of Disease, Health Condition, or Threat

The Secretary must identify in the Declaration, for each Covered Countermeasure, the categories of diseases, health conditions, or threats to health for which the Secretary recommends the administration or use of the countermeasure. In Section VIII of the Declaration, the Secretary states that the disease threat for which he recommends administration or use of the Covered Countermeasures is COVID-19 caused by SARS-CoV-2 or a virus mutating therefrom.

Section IX. Administration of Covered Countermeasures

The PREP Act does not explicitly define the term “administration” but does assign the Secretary the responsibility to provide relevant conditions in the Declaration. In Section IX of the Declaration, the Secretary defines “Administration of a Covered Countermeasure,” as follows:

Administration of a Covered Countermeasure means physical provision of the countermeasures to recipients, or activities and decisions directly relating to public and private delivery, distribution, and dispensing of the countermeasures to recipients; management and operation of countermeasure programs; or management and operation of locations for purpose of distributing and dispensing countermeasures.

The definition of “administration” extends only to physical provision of a countermeasure to a recipient, such as vaccination or handing drugs to patients, and to activities related to management and operation of programs and locations for providing countermeasures to recipients, such as decisions and actions involving security and queuing, but only insofar as those activities directly relate to the countermeasure activities. Claims for which Covered Persons are provided immunity under the Act are losses caused by, arising out of, relating to, or resulting from the administration to or use by an individual of a Covered Countermeasure consistent with the terms of a Declaration issued under the Act. Under the definition, these liability claims are precluded if they allege an injury caused by a countermeasure, or if the claims are due to manufacture, delivery, distribution, dispensing, or management and operation of countermeasure programs at distribution and dispensing sites.

Thus, it is the Secretary’s interpretation that, when a Declaration is in effect, the Act precludes, for example, liability claims alleging negligence by a manufacturer in creating a vaccine, or negligence by a health care provider in prescribing the wrong dose, absent willful misconduct. Likewise, the Act precludes a liability claim relating to the management and operation of a countermeasure distribution program or site, such as a slip-and-fall injury or vehicle collision by a recipient receiving a countermeasure at a retail store serving as an administration or dispensing location that alleges, for example, lax security or chaotic crowd control. However, a liability claim alleging an injury occurring at the site that was not directly related to the countermeasure activities is not covered, such as a slip and fall with no direct connection to the countermeasure’s administration or use. In each case, whether immunity is applicable will depend on the particular facts and circumstances.

Section X. Population

The Secretary must identify, for each Covered Countermeasure specified in a Declaration, the population or populations of individuals for which liability immunity is in effect with respect to administration or use of the countermeasure. Section X of the Declaration identifies which individuals should use the countermeasure or to whom the countermeasure should be administered—in short, those who should be vaccinated or take a drug or other countermeasure. Section X provides that the population includes “any individual who uses or who is administered a Covered Countermeasure in accordance with the Declaration.”

It should be noted that under the PREP Act, liability protection extends beyond the Population specified in the Declaration. Specifically, liability immunity is afforded (1) To manufacturers and distributors without regard to whether the countermeasure is used by or administered to this population, and (2) to program planners and qualified persons when the countermeasure is either used by or administered to this population or the program planner or qualified person reasonably could have believed the recipient was in this population. Section X of the Declaration includes these statutory conditions in the Declaration for clarity.

Section XI. Geographic Area

The Secretary must identify, for each Covered Countermeasure specified in the Declaration, the geographic area or areas for which liability immunity is in effect, including, as appropriate, whether the Declaration applies only to Start Printed Page 15201individuals physically present in the area or, in addition, applies to individuals who have a described connection to the area. Section XI of the Declaration provides that liability immunity is afforded for the administration or use of a Covered Countermeasure without geographic limitation. This could include claims related to administration or use in countries outside the U.S. It is possible that claims may arise in regard to administration or use of the Covered Countermeasures outside the U.S. that may be resolved under U.S. law.

In addition, the PREP Act specifies that liability immunity is afforded (1) to manufacturers and distributors without regard to whether the countermeasure is used by or administered to individuals in the geographic areas, and (2) to program planners and qualified persons when the countermeasure is either used or administered in the geographic areas or the program planner or qualified person reasonably could have believed the countermeasure was used or administered in the areas. Section XI of the Declaration includes these statutory conditions in the Declaration for clarity.

Section XII. Effective Time Period

The Secretary must identify, for each Covered Countermeasure, the period or periods during which liability immunity is in effect, designated by dates, milestones, or other description of events, including factors specified in the PREP Act. Section XII of the Declaration extends the effective period for different means of distribution of Covered Countermeasures through October 1, 2024 .

Section XIII. Additional Time Period of Coverage

The Secretary must specify a date after the ending date of the effective time period of the Declaration that is reasonable for manufacturers to arrange for disposition of the Covered Countermeasure, including accepting returns of Covered Countermeasures, and for other Covered Persons to take appropriate actions to limit administration or use of the Covered Countermeasure. In addition, the PREP Act specifies that, for Covered Countermeasures that are subject to a Declaration at the time they are obtained for the Strategic National Stockpile (SNS) under 42 U.S.C. 247d-6b(a), the effective period of the Declaration extends through the time the countermeasure is used or administered. Liability immunity under the provisions of the PREP Act and the conditions of the Declaration continue during these additional time periods. Thus, liability immunity is afforded during the “Effective Time Period,” described under Section XII of the Declaration, plus the “Additional Time Period” described under Section XIII of the Declaration.

Section XIII of the Declaration provides for 12 months as the Additional Time Period of coverage after expiration of the Declaration. Section XIII also explains the extended coverage that applies to any product obtained for the SNS during the effective period of the Declaration.

Section XIV. Countermeasures Injury Compensation Program

Section 319F-4 of the PHS Act, 42 U.S.C. 247d-6e, authorizes the Countermeasures Injury Compensation Program (CICP) to provide benefits to eligible individuals who sustain a serious physical injury or die as a direct result of the administration or use of a Covered Countermeasure. Compensation under the CICP for an injury directly caused by a Covered Countermeasure is based on the requirements set forth in this Declaration, the administrative rules for the Program, and the statute. To show direct causation between a Covered Countermeasure and a serious physical injury, the statute requires “compelling, reliable, valid, medical and scientific evidence.” The administrative rules for the Program further explain the necessary requirements for eligibility under the CICP. Please note that, by statute, requirements for compensation under the CICP may not align with the requirements for liability immunity provided under the PREP Act. Section XIV of the Declaration, “Countermeasures Injury Compensation Program,” explains the types of injury and standard of evidence needed to be considered for compensation under the CICP.

Further, the administrative rules for the CICP specify that if countermeasures are administered or used outside the United States, only otherwise eligible individuals at United States embassies, military installations abroad (such as military bases, ships, and camps) or at North Atlantic Treaty Organization (NATO) installations (subject to the NATO Status of Forces Agreement) where American servicemen and servicewomen are stationed may be considered for CICP benefits. Other individuals outside the United States may not be eligible for CICP benefits.

Section XV. Amendments

Section XV of the Declaration confirms that the Secretary may amend any portion of this Declaration through publication in the Federal Register.

DECLARATION

Declaration for Public Readiness and Emergency Preparedness Act Coverage for medical countermeasures against COVID-19.

I. DETERMINATION OF PUBLIC HEALTH EMERGENCY

42 U.S.C. 247d-6d(b)(1)

I have determined that the spread of SARS-CoV-2 or a virus mutating therefrom and the resulting disease COVID-19 constitutes a public health emergency.

II. FACTORS CONSIDERED

42 U.S.C. 247d-6d(b)(6)

I have considered the desirability of encouraging the design, development, clinical testing, or investigation, manufacture, labeling, distribution, formulation, packaging, marketing, promotion, sale, purchase, donation, dispensing, prescribing, administration, licensing, and use of the Covered Countermeasures.

III. RECOMMENDED ACTIVITIES

42 U.S.C. 247d-6d(b)(1)

I recommend, under the conditions stated in this Declaration, the manufacture, testing, development, distribution, administration, and use of the Covered Countermeasures.

IV. LIABILITY IMMUNITY

42 U.S.C. 247d-6d(a), 247d-6d(b)(1)

Liability immunity as prescribed in the PREP Act and conditions stated in this Declaration is in effect for the Recommended Activities described in Section III.

V. COVERED PERSONS

42 U.S.C. 247d-6d(i)(2), (3), (4), (6), (8)(A) and (B)

Covered Persons who are afforded liability immunity under this Declaration are “manufacturers,” “distributors,” “program planners,” “qualified persons,” and their officials, agents, and employees, as those terms are defined in the PREP Act, and the United States.